Introduction

Managing money has never been more important than in 2025. With rising living costs and new investment opportunities, the right financial tools can help you stay in control, save more effectively, and grow your wealth. Luckily, finance apps today go far beyond simple calculators—they act like personal advisors in your pocket.

Here are the Top 3 finance apps in 2025 that can help you master your money.

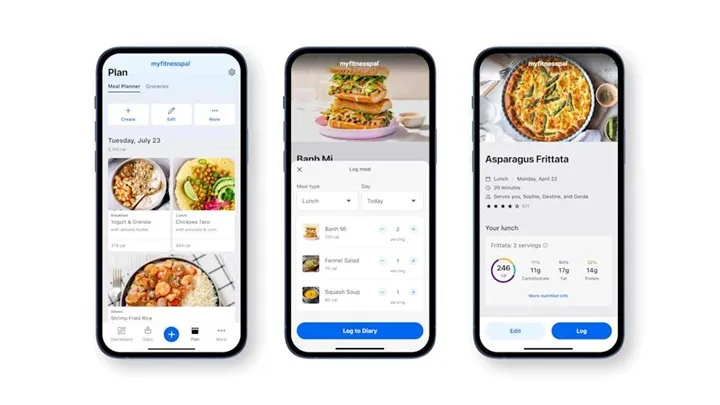

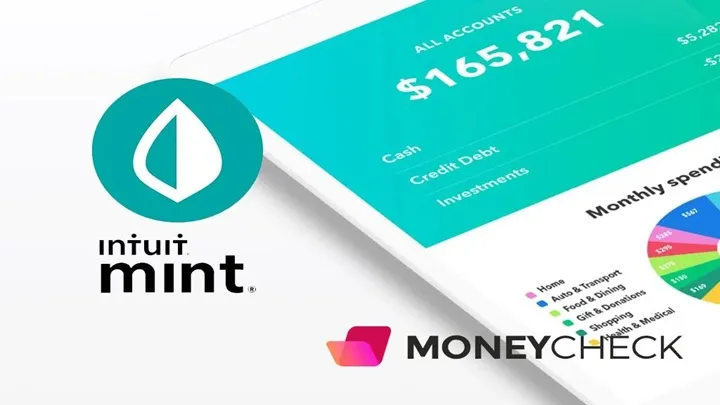

1. Mint – All-in-One Budget Planner

Mint remains one of the most popular budgeting apps worldwide. It gives you a clear picture of your finances by tracking expenses, income, and bills automatically.

Why it’s essential:

- Syncs with bank accounts and credit cards for real-time tracking.

- Provides insights into spending habits and savings opportunities.

- Sends reminders for bills and due dates.

- Easy-to-use interface for beginners.

Mint helps you stay on top of your budget and avoid unnecessary spending.

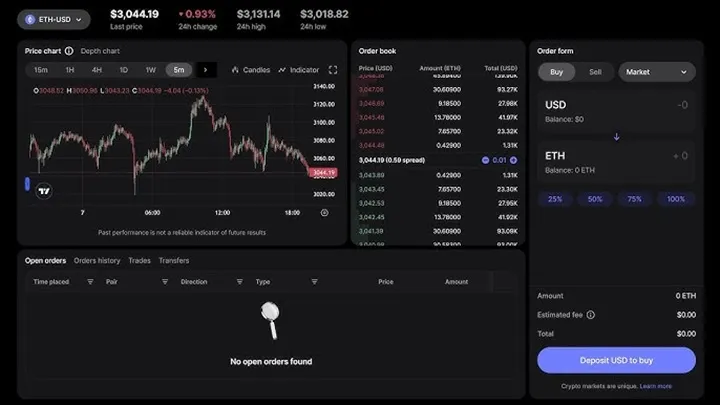

2. Robinhood – Investment Made Simple

Robinhood has transformed the way people invest by making stock trading, crypto, and ETFs accessible to everyone. In 2025, it’s still one of the leading apps for beginner and casual investors.

Why it’s essential:

- Commission-free stock and crypto trading.

- Simple, intuitive design for first-time investors.

- Educational content to help users understand the market.

- Tools for both long-term investing and short-term trading.

With Robinhood, investing is no longer intimidating—it’s approachable and affordable.

3. Revolut – Digital Banking Reinvented

Revolut has grown into a powerful all-in-one financial app. It offers digital banking, international transfers, and even crypto trading, making it perfect for global users.

Why it’s essential:

- Low-cost currency exchange and international payments.

- Budgeting tools and spending analytics.

- Virtual cards for secure online shopping.

- Options for investing in stocks and crypto.

Revolut is especially valuable for travelers and digital nomads who need flexibility and control.

Conclusion

From budgeting with Mint, to investing with Robinhood, and banking with Revolut, these three apps are must-haves in 2025 for smarter money management. They cover everything from daily expenses to global transactions, giving you the tools to take control of your financial future.

If financial stability and growth are on your 2025 goals list, these apps are the perfect place to start.